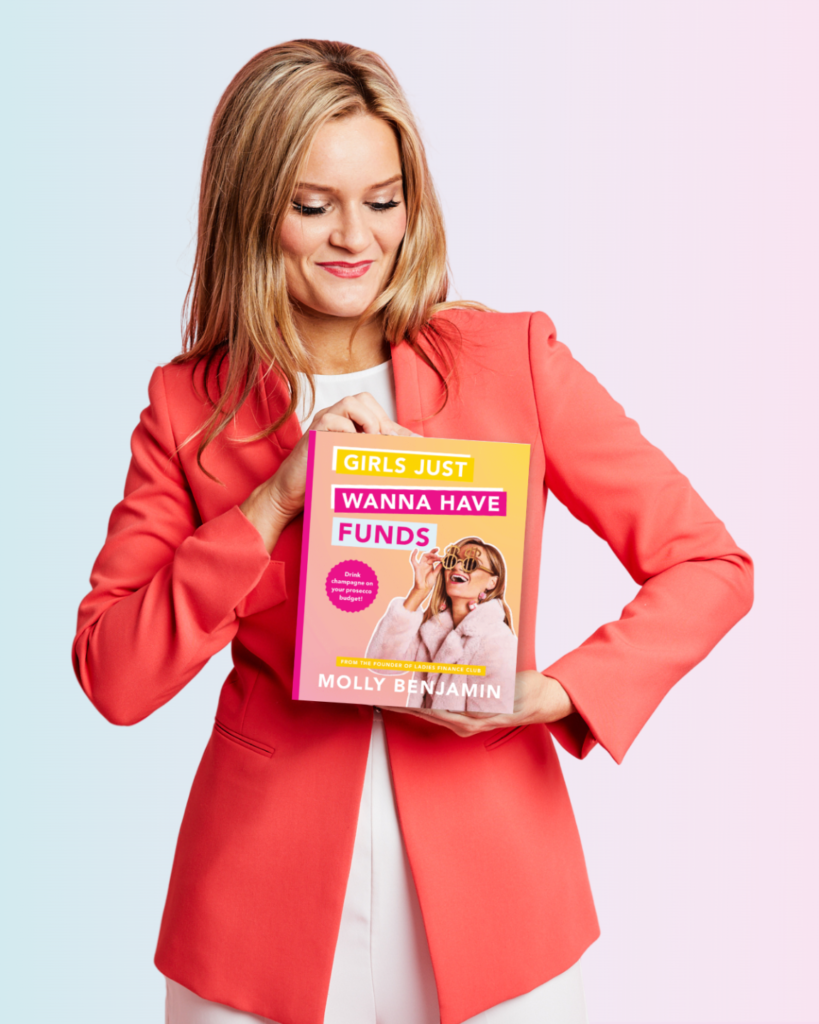

Meet Molly Benjamin, the founder of The Finance Ladies Club. This group empowers women to take control of their financial futures by hosting engaging events and online workshops. They also provide tips via their social media to simplify financial jargon on various topics such as investing, building an emergency fund, insurance, super, debt, and budgeting. Let’s dive into the world of finance and how to budget with Molly.

Tell us a bit about yourself, the Ladies Finance Club and what inspired you to start it.

So, big confession: I used to be really bad with money. I’d prefer to get a Brazilian wax than do a budget, and my investments were made up of good times and clothes. Ironically, I was also working at a bank at the time. I realised that many women in my life were all pretty clueless when it came to money. I would always hear phrases like “I’m just so bad with money” or “I don’t know where to begin.”

As I did a little more research, I found that women live longer, earn less, retire with less super, and invest less. In fact, a mother’s earnings will fall by 55% in the first five years after giving birth, while a father’s won’t change at all. The highest-growing demographic of people experiencing homelessness in Australia is single women over the age of 55. I didn’t want that for any woman in my life, so I decided to do something about it.

I started running events in my living room, inviting a friend who worked in finance over to teach us about money. We outgrew my living room very quickly. Now, we’ve had 50,000 women go through our programs, corporate workshops, courses, and masterclasses. We’re all about creating a safe space where women can come together and learn from some of the best experts in the country about money. When we have control over our money, we have control over our lives.

At what age should women start looking into managing their personal finances?

As soon as you start earning money! Being good with money is all about behaviour and discipline, not how smart you are or how much you earn. So, set yourself up with good habits from the get-go! This includes saving a portion of your paycheck, investing in the share market (which is a lot easier than most people believe) and avoiding bad debts like credit cards and Afterpay.

I always say the first step to getting your personal finances sorted is to set up an emergency fund (because life happens) or, as we call them, OMG moments. Start with saving just $1,000 and build it up to the equivalent of 3-6 months’ worth of expenses. Keep it in a high-interest, fee-free savings account.

The reason this is so important is that it’s the first step towards financial wellbeing. By doing this, you’re already ahead of the game! So start building an OMG fund for moments like “OMG, there’s a global pandemic, and I’ve lost my job,” or “OMG, the car needs repairs,” not for “OMG, I want those shoes,” or “OMG, a round of shots on me at 1am.”

What are the top three budgeting tips you recommend for young women to start building a strong financial foundation?

1. Save for something that you ACTUALLY want! “I’m not good with money!” I heard my galpal say the other day, but my god, she was good when she was hunting for deals on Airbnb and comparing against Stayz figuring out which online platform had the best discounts. The thing is, when something excites or interests us, we care. So, we need to get interested in our money, and a great way to do this is to save for something you really want. Write out what you want to achieve with your money—then do the 3 D’s – the dollar amount, deadline and details!

2. Tell your money where to go so you don’t have to wonder where it went. There are two main budgeting methods I break down in my book ‘Girls Just Wanna Have Funds’: the Zero-Based Budgeting method and the 50/30/20 rule. The 50/30/20 Rule is simply where you set up three accounts, label them, and move that percentage of money into them each paycheck (I like to give mine nicknames because “Treat Yo Self Account” just seems a bit more exciting than “Account: 407652”). Let’s say $10k hits your account every month:

- $5,000 (50%) goes to the Financially Adulting Account—for the boring but important things (bills, mortgage, rent—you get the gist).

- $3,000 (30%) goes to the Fun Money (or Treat Yo Self) Account (my fave—for brunch, lunch, clothes, travels, etc.).

- $2,500 (20%) goes to the Future Me Account (for investments, property, extra into super, etc.).

Can you share some practical ways to save money while still enjoying a boujee lifestyle on a budget?

Absolutely! Here are some super easy ways to keep living your boujee life without blowing your budget:

Be upfront and honest with your mates if you’re on a budget – remember you’re saying no to things now so you can say YES to the things that you’ve thought about and really want. It’s easy to get caught up on the current of life and spend spend spend.

Fine dining deals: Hit up fancy places for lunch or weekday dinners when they offer special deals. Apps like First Table and Eat Club are great for snagging those discounts. And don’t forget happy hour menus and specials—$5 taco nights, anyone #mexicellent!

Opt for coffee dates over breakfast: Walk and Coffee: Instead of meeting for an expensive breakfast, go for a walk and grab coffee. It’s a great way to catch up and enjoy some fresh air without spending too much.

Budget for luxuries: Put aside a little bit each month for luxury items or experiences. This way, you can still treat yourself without going overboard or feeling guilty about it.

How can young women balance being frugal with indulging in occasional splurges without feeling guilty?

Remember, you earn money to enjoy it, and you can save, and invest, but also enjoy the moment. I meet women who never spend any money on themselves and others who are in debt because they’ve spent too much. You want to create a nice balance.

Create a fun money account by designating a specific portion of your income just for guilt-free spending. Aim for around 20% of your income. This is your fun money, meant for those little indulgences that bring joy without the stress. Once your fun money runs out, the fun stops. This helps keep your spending in check while still allowing for those occasional splurges.

This all funnels down to identifying what truly brings you happiness and focusing your fun money there. Whether it’s dining out, new clothes, or a hobby, knowing what matters most to you ensures that your splurges are worth it and align with your values.

Share a couple of truths and myths about managing personal finances that you’ve learned along your journey.

Myth 1: You need to be rich to invest. Many believe that investing is only for the wealthy, but that’s not true. With various options available, like robo-advisors and micro-investing apps, anyone can start investing with small amounts of money.

Myth 2: debt is always bad: Not all debt is created equal. While high-interest debt can be harmful (credit cards, personal payday loans, Afterpay), taking on low-interest debt for education or a mortgage can be a strategic move that supports your long-term financial goals.

Myth 3: The more you make the more you save. Lifestyle inflation happens when your spending increases as your income grows, leaving you with little to no savings despite earning more. It’s crucial to maintain financial discipline and stick to your budget, ensuring that your savings and investments grow along with your income. This way, you can avoid the pitfalls of lifestyle inflation.

Your book, ‘Girls Just Wanna Have Funds’ sounds like an anthem for us in today’s economy as the cost of living skyrockets. Can you tell us a bit about your book and what response you have received from your readers?

It’s a practical fun guide to do with your girlfriends that takes you through all areas of personal finance. Each chapter tackles a new concept, from understanding where your attitudes towards money come from to investing, superannuation, and salary negotiation. There are actions you need to take. It’s for those who can name the Kardashians but not how much they spent last month.

Tell us a little (or as much as you can share!) about your exciting new event series.

We will be travelling around the country to over 9 locations in October teaching women how to get on the property ladder! You can check out all the details below.

Read more of our Inspiring Profiles here.